The history of Baltic Horizon

Explore the important milestones from the launch in 2010 and the Nasdaq listings in 2016 and to today.

2025

Completion of Share Sale Transaction

In October of 2025, Northern Horizon Capital AS former sole shareholder, Northern Horizon A/S, transferred ownership of the Estonian-licensed fund management company to the partners of the private investment firm Grinvest.

2025

Termination of the SDR program

In October of 2025, the Fund terminated the SDR program delisted the SDR from Nasdaq Stockholm.

2024

Private placement of new units

In September of 2024, Baltic Horizon Fund completed a private placement of new units. 23,927,085 new units corresponding to a gross value of EUR 6.29 m were issued and subsequently listed on the Nasdaq Tallinn Stock Exchange, with the first day of trading on 20 September 2024.

2022

Meraki Business Home completed

Baltic Horizon fund completed the first phase of the fund’s first construction project Meraki Business Home in Pašilaičiai, a growing business area in Vilnius. The first tower of just over 8,100 m2 of office space opened in August of 2022.

2022

Swedish Depository Receipts

In October of 2022, Baltic Horizon Fund completed a delisting of Swedish traded Baltic Horizon Fund units from Nasdaq Stockholm and in connection with that enabling a conversion of the Swedish traded Baltic Horizon Fund units to Swedish Depositary Receipts. The first trading day of Baltic Horizon Fund SDR’s on Nasdaq Stockholm was 31 October 2022.

2021

The fourth Nasdaq listing

In November of 2021, Baltic Horizon completed a bond listing of Meraki SPV bonds on Nasdaq First North. The bond listing was the Fund’s fourth Nasdaq listing.

2021

The first property disposal

In November of 2021, with the sale of the G4S building in Tallinn, Estonia, Baltic Horizon made its first disposal in the fund’s history.

2021

Private placement to finance the Meraki Business Home construction

In May of 2021, Baltic Horizon announced plans to complete a private placement of bonds to finance the construction of the Meraki Business Home building in Vilnius, Lithuania.

2020

Focus on diversification and growth

In 2020, Baltic Horizon Fund completed a secondary public offering to fund the development of already owned investment properties and also to acquire new properties to achieve wider diversification of the portfolio.

2019

Private placements and new acquisition

In 2019, Baltic Horizon completed private placements of new Baltic Horizon Fund units and on 13 June 2019, the acquisition of Galerija Centrs Shopping Centre was announced. Some of the proceeds from the private placements were used to finance the acquisition of the historic shopping center.

2018

The first construction project

In 2018, Baltic Horizon Fund completed the acquisition 0.87 hectares of land next to the Domus Pro complex in Vilnius, Lithuania. In 2019, the building permit was received in 2019 allowing to build Meraki Business Home – the fund’s first construction project with approx. 15,800 sq. m. of leasable office space along with a parking house.

2018

Listing of Baltic Horizon Fund Bonds on Baltic Bond List

In May of 2018, Baltic Horizon completed a subscription of Baltic Horizon Fund 5-year unsecured bonds by way of private placement. The bonds were listed on Nasdaq Tallinn in August 2018. The purpose of the bond issuance was to refinance bank loans to minimize bank loan amortization payments but also for investment activities. Later the same year, Baltic Horizon Fund completed a subsequent EUR 10 million bond subscription.

2018

S&P Global Ratings

In 2018, S&P Global Ratings assigned an 'MM3' mid-market evaluation (MME) rating to Baltic Horizon Fund. Baltic Horizon was the first issuer listed on the Nasdaq Baltic Stock Exchange to become rated by a global rating agency. The indicative corresponding rating between the MME rating scale of 'MM3' to the global rating scale was 'BB+ / BB'.

2017

Secondary public offering of units

In 2017, Baltic Horizon Fund completed a secondary public offering of units.

2016

First trading day on Nasdaq Stockholm

Baltic Horizon became dual-listed on Nasdaq Stockholm’s Alternative Investment Funds market. The first trading day of Baltic Horizon Fund units on Nasdaq Stockholm was 23 December 2016.

2016

The first acquisition as a listed fund

Baltic Horizon took over G4S Headquarters in Tallinn just days after the listing on Nasdaq Tallinn Stock Exchange. With the G4S acquisition, the portfolio consisted of 6 properties worth in excess of EUR 100 million.

2016

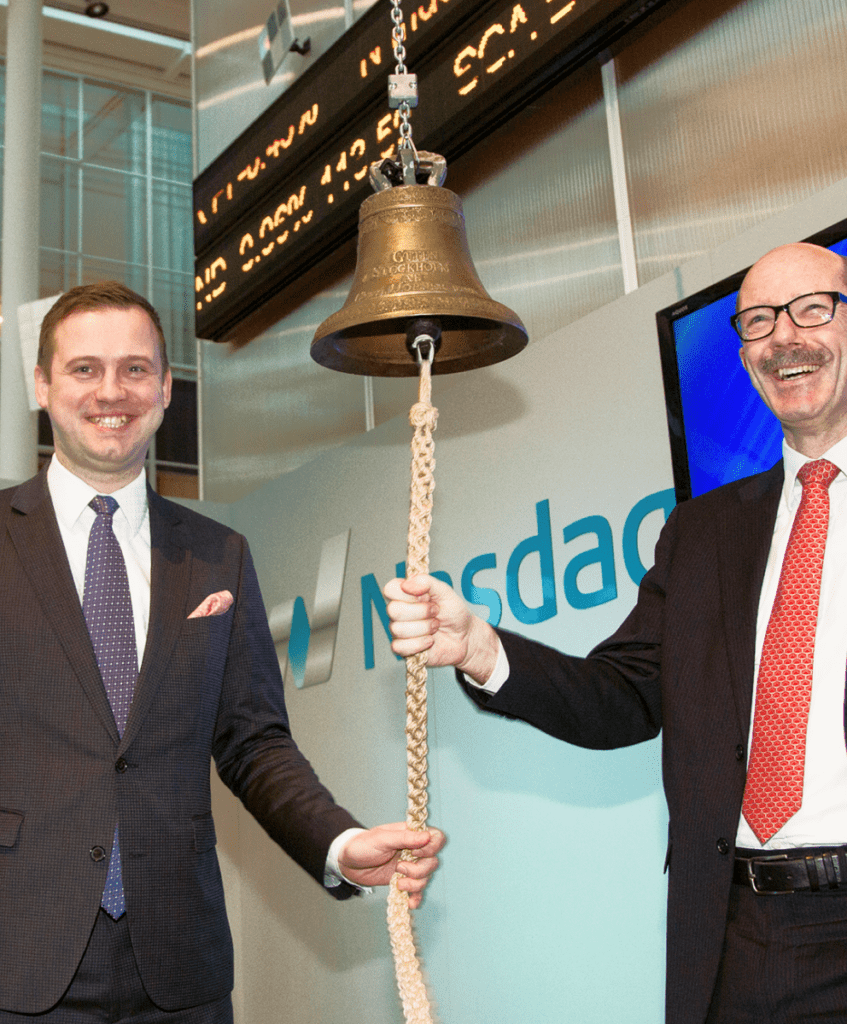

Listing on Nasdaq Tallinn

As the first public real estate fund ever, Baltic Horizon was listed on Nasdaq Tallinn exchange.

2016

Merger between Baltic Horizon and Baltic Opportunity Fund

Following a successful capital raising, Baltic Horizon merged with Baltic Opportunity Fund on 30 June 2016. Baltic Horizon Fund was the remaining entity taking over 5 assets of Baltic Opportunity Fund and its investor base.

2011

The first investment

In July of 2011, Baltic Opportunity Fund made its first investment. The Lincona office complex in Tallinn was acquired for EUR 15.4 million.

2010

Launch of Baltic Opportunity Fund

In December of 2010, Baltic Opportunity Fund closed its first capital raising that amounted to EUR 5.5 million. The investment preposition of the fund was to take advantage of a potential post-crisis recovery of Baltic property markets.

2025

Completion of Share Sale Transaction

In October of 2025, Northern Horizon Capital AS former sole shareholder, Northern Horizon A/S, transferred ownership of the Estonian-licensed fund management company to the partners of the private investment firm Grinvest.

2025

Termination of the SDR program

In October of 2025, the Fund terminated the SDR program delisted the SDR from Nasdaq Stockholm.

2024

Private placement of new units

In September of 2024, Baltic Horizon Fund completed a private placement of new units. 23,927,085 new units corresponding to a gross value of EUR 6.29 m were issued and subsequently listed on the Nasdaq Tallinn Stock Exchange, with the first day of trading on 20 September 2024.

2022

Meraki Business Home completed

Baltic Horizon fund completed the first phase of the fund’s first construction project Meraki Business Home in Pašilaičiai, a growing business area in Vilnius. The first tower of just over 8,100 m2 of office space opened in August of 2022.

2022

Swedish Depository Receipts

In October of 2022, Baltic Horizon Fund completed a delisting of Swedish traded Baltic Horizon Fund units from Nasdaq Stockholm and in connection with that enabling a conversion of the Swedish traded Baltic Horizon Fund units to Swedish Depositary Receipts. The first trading day of Baltic Horizon Fund SDR’s on Nasdaq Stockholm was 31 October 2022.

2021

The fourth Nasdaq listing

In November of 2021, Baltic Horizon completed a bond listing of Meraki SPV bonds on Nasdaq First North. The bond listing was the Fund’s fourth Nasdaq listing.

2021

The first property disposal

In November of 2021, with the sale of the G4S building in Tallinn, Estonia, Baltic Horizon made its first disposal in the fund’s history.

2021

Private placement to finance the Meraki Business Home construction

In May of 2021, Baltic Horizon announced plans to complete a private placement of bonds to finance the construction of the Meraki Business Home building in Vilnius, Lithuania.

2020

Focus on diversification and growth

In 2020, Baltic Horizon Fund completed a secondary public offering to fund the development of already owned investment properties and also to acquire new properties to achieve wider diversification of the portfolio.

2019

Private placements and new acquisition

In 2019, Baltic Horizon completed private placements of new Baltic Horizon Fund units and on 13 June 2019, the acquisition of Galerija Centrs Shopping Centre was announced. Some of the proceeds from the private placements were used to finance the acquisition of the historic shopping center.

2018

The first construction project

In 2018, Baltic Horizon Fund completed the acquisition 0.87 hectares of land next to the Domus Pro complex in Vilnius, Lithuania. In 2019, the building permit was received in 2019 allowing to build Meraki Business Home – the fund’s first construction project with approx. 15,800 sq. m. of leasable office space along with a parking house.

2018

Listing of Baltic Horizon Fund Bonds on Baltic Bond List

In May of 2018, Baltic Horizon completed a subscription of Baltic Horizon Fund 5-year unsecured bonds by way of private placement. The bonds were listed on Nasdaq Tallinn in August 2018. The purpose of the bond issuance was to refinance bank loans to minimize bank loan amortization payments but also for investment activities. Later the same year, Baltic Horizon Fund completed a subsequent EUR 10 million bond subscription.

2018

S&P Global Ratings

In 2018, S&P Global Ratings assigned an 'MM3' mid-market evaluation (MME) rating to Baltic Horizon Fund. Baltic Horizon was the first issuer listed on the Nasdaq Baltic Stock Exchange to become rated by a global rating agency. The indicative corresponding rating between the MME rating scale of 'MM3' to the global rating scale was 'BB+ / BB'.

2017

Secondary public offering of units

In 2017, Baltic Horizon Fund completed a secondary public offering of units.

2016

First trading day on Nasdaq Stockholm

Baltic Horizon became dual-listed on Nasdaq Stockholm’s Alternative Investment Funds market. The first trading day of Baltic Horizon Fund units on Nasdaq Stockholm was 23 December 2016.

2016

The first acquisition as a listed fund

Baltic Horizon took over G4S Headquarters in Tallinn just days after the listing on Nasdaq Tallinn Stock Exchange. With the G4S acquisition, the portfolio consisted of 6 properties worth in excess of EUR 100 million.

2016

Listing on Nasdaq Tallinn

As the first public real estate fund ever, Baltic Horizon was listed on Nasdaq Tallinn exchange.

2016

Merger between Baltic Horizon and Baltic Opportunity Fund

Following a successful capital raising, Baltic Horizon merged with Baltic Opportunity Fund on 30 June 2016. Baltic Horizon Fund was the remaining entity taking over 5 assets of Baltic Opportunity Fund and its investor base.

2011

The first investment

In July of 2011, Baltic Opportunity Fund made its first investment. The Lincona office complex in Tallinn was acquired for EUR 15.4 million.

2010

Launch of Baltic Opportunity Fund

In December of 2010, Baltic Opportunity Fund closed its first capital raising that amounted to EUR 5.5 million. The investment preposition of the fund was to take advantage of a potential post-crisis recovery of Baltic property markets.