Baltic Horizon Fund SFDR disclosures

Summary

The objective of the Fund is to combine attractive income yields with medium to long-term value appreciation by identifying and investing primarily in real estate, portfolios of real estate, real estate companies and/or securities related to real estate and successfully exiting from these investments.

The Fund invests in commercial real estate located in Estonia, Latvia, and Lithuania, with a particular focus on the capitals – Tallinn, Riga, and Vilnius – and a preference for city centres within or near the central business districts.

The Fund targets Modern City Life strategy. The strategy of modern living prioritizes convenience, multifunctionality, efficiency, and quality of life within urban environments. It reflects the evolving needs and preferences of urban dwellers who seek a balance between work, lifestyle, and community engagement.

The Fund promotes environmental and social characteristics such as GHG emission reduction and environmental certification. When investing in new assets, the Fund will focus on locations that allow access to services by walking, cycling and public transport. In connection to promoting the environmental characteristics the Fund has the following targets:

- Operational in-use net zero carbon by 2030

- 100% fossil-free electricity by 2030 across all real estate assets in the portfolio;

- 100 % certified (BREEAM in use or similar standard) assets by 2030;

- 100% green lease clauses signed by the tenants to ensure tenant collaboration on the best effort basis on sustainability matters.

The promoted characteristics are measured by percentage of the assets in the portfolio that use fossil-free electricity, percentage of non-fossil electricity in the portfolio, portfolio’s operational in-use GHG emissions scope 1-3, percentage of portfolio certification coverage, and percentage of the portfolio where tenants signed the green lease clauses.

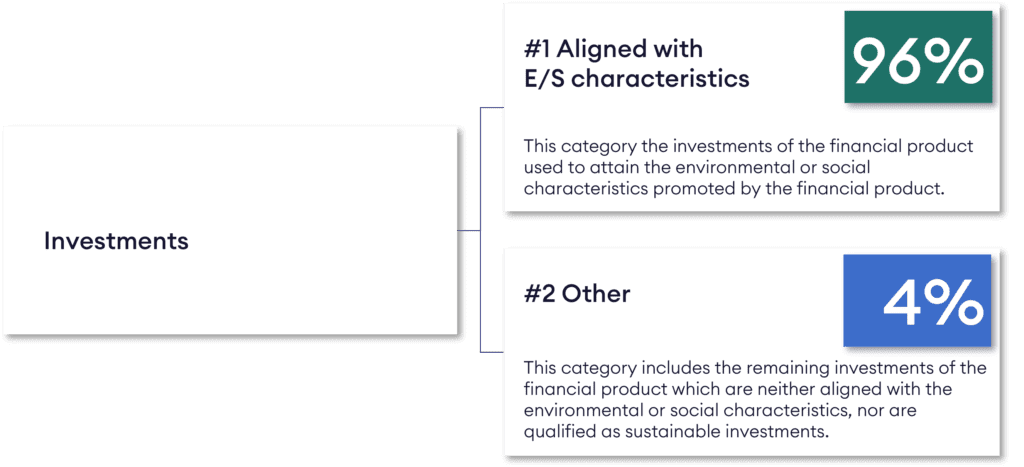

To meet the promoted environmental characteristics, the Fund plans to generally invest up to 96% of its total equity commitments into real estate properties which are aligned with the Fund’s promoted E/S characteristics. The remaining proportion of investments, amounting up to 4% of the Fund’s assets, could be held in a form of cash or cash equivalents to maintain sufficient liquidity.

In accordance with Northern Horizon Capital Group’s Responsible Investment policy and Investment policy, promoted environmental factors are to be considered as part of any due diligence process on a targeted investment and a summary conclusion provided as part of the investment proposal as further instructed by Northern Horizon Capital Group’s Investment Policy. In addition to monitoring asset level actions, ESG Task Force may recommend and present fund specific actions to attain the fund’s sustainability targets.

The Fund collects information on the sustainability indicators with the assistance of asset managers, property managers and in cooperation with the tenants. Taxonomy alignment is assessed in connection to the investment decision making by utilizing Northern Horizon’s own taxonomy screening tool. Sustainability data is managed and processed in an ESG data and reporting platform. At the current, the Manager does not see material limitations of data affecting the attainment of the promoted characteristics.

Baltic Horizon Fund SFDR disclosures

No sustainable investment objective

This financial product promotes environmental or social characteristics but does not have as its objective sustainable investment.

Environmental or social characteristics of the financial product

This financial product promotes environmental and social characteristics such as GHG emission reduction and environmental certification. When investing in new assets, the Fund will focus on locations that allow access to services by walking, cycling and public transport.

In connection to promoting the environmental characteristics the Fund has the following targets :

- Operational in-use net zero carbon by 2030

- 100% fossil-free electricity by 2030 across all real estate assets in the portfolio;

- 100 % certified (BREEAM in use or similar standard) assets by 2030;

- 100% green lease clauses signed by the tenants to ensure tenant collaboration on the best effort basis on sustainability matters.

Investment strategy

The Fund’s primary focus is to invest directly in commercial real estate located in Estonia, Latvia and Lithuania with a particular focus on the capitals – Tallinn, Riga and Vilnius. The Fund’s focus is on established cash flow-generating properties with the potential to add value through active management within the retail, office, leisure and logistics segments in strategic locations and strong tenants or a quality tenant mix and long leases. Up to 20% of the Fund’s assets may be allocated to investments of a more opportunistic nature such as forward funding development projects and undeveloped land purchases. The Fund aims to have LTV 50 % or lower. At no point in time may the Fund’s leverage exceed 65%. The Fund aims to grow through making attractive investments for its investors while diversifying its risks geographically, across real estate segments, tenants and debt providers.

The Fund invests in all types of real estate properties, including retail, office, and logistics properties. The Fund more specifically targets Modern City Life strategy. The strategy of modern living prioritizes convenience, multifunctionality, efficiency, and quality of life within urban environments. It reflects the evolving needs and preferences of urban dwellers who seek a balance between work, lifestyle, and community engagement.

The investment strategy aims for operational net zero by 2030. In real estate operations, carbon dioxide emissions derive mainly from energy use, i.e. electricity and heating. Therefore, the investment strategy aims at achieving its promoted characteristics 100% fossil free electricity by 2030.

The Fund acquires real estate assets that are placed in special purpose vehicles for the benefit and purpose of housing these real estate assets. Therefore, the governance practices of these entities are not assessed. However, the management company of the Fund upholds itself to the highest corporate governance practices and all relevant regulations. Good governance principles are also an integral part of the Fund management that also stretches to special purpose vehicles housing the real estate assets.

In order to comply with the minimum safeguards for human rights, the Fund conducts a human rights risk assessment biannually in accordance with Northern Horizon Capital Group Responsible investment policy.

Proportion of investments

To meet the promoted environmental characteristics, the Fund plans to generally invest up to 96% of its total equity commitments into real estate properties which are aligned with the Fund’s promoted E/S characteristics. The remaining proportion of investments, amounting up to 4% of the Fund’s assets, could be held in a form of cash or cash equivalents to maintain sufficient liquidity.

Monitoring of environmental or social characteristics

Each promoted characteristic is monitored separately based on the relevant metric:

- percentage of the assets in the portfolio that use fossil-free electricity,

- percentage of non-fossil electricity in the portfolio,

- portfolio’s operational in-use GHG emissions scope 1-3

- percentage of portfolio certification coverage, and

- percentage of the portfolio where tenants signed the green lease clauses.

The Manager, Northern Horizon Capital A/S assumes responsibility for the data quality and integrity of the sustainability indicators but may use external sustainability advisors to facilitate data collection and analysis where appropriate. Data on sustainability indicators is gathered directly from the assets and monitored with the assistance of external property managers.

The sustainability indicators are investigated in the due diligence phase for new investments and measured and reported at least annually. Northern Horizon Capital has established an ESG Task force that is led by Head of Sustainability and includes the Fund and Asset Managers. In accordance with Northern Horizon Capital Group’s Responsible Investment policy, the Task Force gathers at least quarterly to discuss the relevant developments of the ESG factors for the Fund and it may recommend actions to achieve the Fund’s targets. The Fund managers are responsible for implementation of the Responsible Investment policy at Fund level.

Methodologies

In accordance with Northern Horizon Capital Group’s Responsible Investment policy, promoted E/S characteristics are to be considered as part of any due diligence process on a targeted investment and a summary conclusion provided as part of the investment proposal as further instructed by Northern Horizon Capital Group’s Investment Policy.

In addition to monitoring asset level actions, ESG Task Force may recommend and present fund specific actions to attain the fund’s sustainability targets.

The Fund will use its best efforts to include green lease clauses in all new lease agreements and renewals of existing leases. Possible green lease clauses include agreements of consumption data sharing, preference over renewable energy forms, landlord assistance in relation to refurbishment projects, use of sustainable products and other matters related to ESG coordination deemed material at time to time.

Data sources and processing

The Fund collects information on the sustainability indicators with the assistance of asset managers, property managers and in cooperation with the tenants. Taxonomy alignment is assessed in connection to the investment decision making by utilizing Northern Horizon Capital’s own taxonomy screening tool. Sustainability data is managed and processed in an ESG data and reporting platform.

In case the Fund would use estimations, they will be assessed and reported on a case-by-case basis.

Limitations to methodologies and data

There may be limitations to data and methodologies due to developing ESG regulations and reporting requirements that are common to the industry. In cases, the complete data may not be available due to renovations or metering deficits among other reasons. The Fund aims to maintain its high data coverage on consumption data and other ESG characteristics and assure data completeness.

The limitations to methodologies and data do not affect the attainment of the promoted characteristics of the Fund.

Due diligence

Due diligence is conducted in accordance with Northern Horizon Capital Group‘s Responsible Investment policy and Investment policy.

ESG factors are to be considered as part of any due diligence process on a targeted investment and a summary conclusion provided as part of the investment proposal as further instructed by Northern Horizon Capital Group’s Investment Policy. For the purpose of assessing sustainability factors and risks in relation to investments, special purpose questionnaires will be used. This questionnaire will cover relevant sustainability matters including but not limited to:

- Assessment of energy performance – energy supply and access to renewable energy, sources of energy consumption data, energy ratings, building certification, emissions and other relevant topics and as laid down in applicable regulation;

- Assessment of environmental aspects – building materials, contamination, water efficiency, water supply, waste management, EU taxonomy4 alignment, green lease provisions and other relevant topics;

- Assessment of social aspects – building safety, indoor environmental quality, health and wellbeing, , tenant and landlord ESG collaboration, other relevant topics;

- Risks associated with new construction and renovations – site selection, biodiversity, developer selection, their commitment to the Minimum Safeguards, waste management, building materials and other relevant topics;

- Other topics – access to transport links, regulatory risks, review of climate change related transition, physical and social risks, as well as human rights risk and should it be relevant for a specific fund, principal adverse impact indicators.

The fund may also utilize the assistance of third-party consultants and property managers to conduct ESG due diligence. Taxonomy screening is conducted in investment decision making.

Engagement policies

The Fund does not have a separate engagement policy. Stakeholder engagement is part of Northern Horizon Capital Group’s Responsible investment policy principle 7 according to which Head of Sustainability, Asset and Fund managers actively engage with our key stakeholders with the goal of improving sustainability and addressing controversies. Fund manager shall make reasonable efforts to ensure access to all relevant ESG data and stakeholder commitment through surveying, goodwill dialogue, and/or contract negotiations.

No designated reference benchmark

The Fund does not follow a reference benchmark.

Link: SFDR pre-contractual disclosure ENG

Sustainability related disclosures for Northern Horizon Capital A/S

Sustainability risk consideration in due diligence

At Northern Horizon Capital A/S and its subsidiaries (“Northern Horizon”) we acknowledge that our real asset activities affect the society and environment around us. Consequently, we have integrated sustainability factors into our investment decision‐making process. By sustainability we mean environmental, social and governance (“ESG”) dimensions of our investment activities.

Northern Horizon has adopted two policies to ensure that sustainability risks are considered in a consistent and coherent manner in connection with all investment decisions. The cornerstone of our sustainability evaluations is our Responsible Investment Policy, which is complemented by our Portfolio Management Policy. Our remuneration policy is also aligned with our Responsible Investment Policy so as to support taking sustainability factors into account in our investment decision‐making process.

According to our policies, sustainability factors and associated risks are considered as part of the due diligence process on targeted investments and the summary conclusion provided as part of the investment proposal. The sustainability factors covered in connection with investment decisions include, but are not limited to:

- Assessment of energy performance – energy supply and access to renewable energy, sources of energy consumption data, energy ratings, building certification, emissions, and other relevant topics.

- Assessment of environmental aspects – building materials, contamination, water efficiency, water supply, waste management and other relevant topics.

- Assessment of social aspects – building safety, indoor environmental quality, health and wellbeing, green clause provisions, tenant and landlord ESG collaboration, other relevant topics.

- Risks associated with new construction and renovations – site selection, biodiversity, developer selection, waste management, building materials and other relevant topics.

- Other topics – access to transport links, regulatory risks, review of climate change related transition, physical and social risks.

Principal adverse impact statement

Statement on principal adverse impacts of investment decisions on sustainability factors

Sustainability risks in remuneration

Northern Horizon has adopted a remuneration policy, which reflects the Group’s objectives for good corporate governance, sustained and long- term value creation for investors and shareholders of the Group, as well as the sustainability objectives. According to the policy, when assessing individual performance of an identified staff member and all other employees, financial as well as non-financial criteria shall be taken into account. The non-financial criteria, can include, but are not limited to ESG specific criteria relevant to an individual fund and / or the Group. Also, the Board of Directors may, in respect of deferred variable remuneration, decide to cancel the payment of the remuneration in whole or in part. This might apply as an example when business objectives are not achieved, including but not limited to ESG objectives.